Passive income for the self employed

I write this to you as a entrepreneur, it feels like writing a letter and reminds me of Paul’s letters to the Israelite. Now, I’m not Paul, and I’m not locked in a cell, though some might say I’m trapped in the solitary confines of entrepreneurship.

This struggle is real and I have to keep it real with you too

Passive income

Even though I’m self-employed, I find it hard to indulge in frivolous ideas. Now, don’t get me wrong, it’s not that I don’t like fancy things — I just don’t have the budget for them. Whether our operating expenses are under $12,000 a month or not, I still won’t buy a new pair of sneakers if the ones I have are still good and look nice. Honestly, we wear less than 10% of our clothes, while the rest just hang there, polished and waiting for a special occasion.

So I’ve learned to replicate my wardrobe. Same style of sneakers and jackets, finding a bespoke tailor to make clothes that look like what I already have. This way, it doesn’t feel like I’m wearing something different, even if I am. I’ve noticed that I rarely wear new patterns in different colors, and so I end up giving them away since I like to keep my wardrobe minimal.

But yeah, this article isn’t about fashion or styling of the very few items in my wardrobe. It’s about the dilemma of passive income for early stage entrepreneurs.

So entrepreneurship “huh’?

Transitioning from a glamorous corporate lifestyle to entrepreneurship is a huge shift. When you’re used to a predictable salary, your expenses stay within a certain curve. But diving into the trenches of early entrepreneurship really tests your willpower. Most entrepreneurs I talk to spend their days in a whirlwind, trying to absorb as much information as possible in short bursts. It’s through these tough experiences that they learn not to look down on 9-5 jobs. You know why?

Entrepreneurship can be traumatic. It’s often why many people sell their companies as soon as they find a buyer—they’re trying to protect their sanity.

Looking back, since I went full-time into entrepreneurship in January 2022, I can confidently say that the media really downplays how hard it is. They make it seem like you can get rich with just a dream and a brilliant idea. This misleads people into thinking it’s easier than it is, and they get upset and give up when reality hits. It takes strategy, knowledge, connections, startup capital, investors, and more.

It’s a LOT 😮💨

In a 9-5, when it’s tough:

- You can blame your boss.

- Blame your co-workers.

- Blame your company.

- Blame the client/customer.

In entrepreneurship:

- You’re the job security.

- You’re responsible for capital.

- You can blame your team (but you take responsibility for everything).

- Your life & relationships can get affected.

- You’re mostly alone, apart from other founders and entrepreneurs who can actually relate to your problems.

That’s why I emphasize it’s traumatic.

For example, yesterday my company’s OpenAI account was automatically flagged by their AI systems. This means that all of a sudden, all the apps we have in production for both our clients and us are halted. I could easily blame someone on the team or a client. But it’s my responsibility to work through the weekend to get our accounts/alternatives reinstated.

Do you imagine that other members of our team on a 9-5 would be freaking out as much as I do? There are customers you can’t tell, “Our OpenAI account got flagged, that is why your app stopped working.” They simply don’t understand that.

However, I honestly believe that we’ve been conditioned to consider the 9-5 variety of tensions and politics as standard/baseline/normal. I’ve done both, and it might be harsh to say entrepreneurship is traumatic because the truth is that BOTH ARE VERY DIFFICULT in their own unique ways. But there is something a 9-5 can assure you that entrepreneurship can’t.

Your next paycheck

Yep!! There have been so many times we didn’t hit our sales target, yet we made payroll. It just wasn’t negotiable. For them, we are their job security. But for the partners/founders, how do we get job security? When running a consultancy, it’s usually one big check/contract every quarter or six months, giving you some runway until the next big cheque. This dilemma made me ask myself: how do I generate my own paycheck system?

I can’t rely on the salary I pay myself in the company because it’s on par with everyone else, and I’m very frugal with spending. But, honestly, I wouldn’t mind treating myself to the occasional spa visit, a resort getaway, or working from a different location without feeling guilty. I’m not an indie developer; I have accountability to clients and the team, so it’s not a free-for-all.

So, I decided to do a little investigation. The following below is just me looking at the components of their user experience, annotating it, and making notes about it. So let’s begin…

Attempt 1: Simple Agreement for Future Income

This is a pun on the term SAFE (Simple Agreement for Future Equity) but with an “I” instead of an “E”—SAFI. It’s basically a loan, and I do this strictly with friends and family members. The idea is simple: I take a chunk of money from my account, say $2000, and lend it out with the condition that the recipient pays back $200 every other month until the initial amount is repaid.

So far, it feels like getting a salary, but it’s with my own money, paid back to me in intervals. It can come in handy on the weirdest days. I track payments in a WhatsApp Group with the specific candidate, and I can’t do this with more than three people at a time, so it doesn’t scale well. But it’s a hack I’ve used to create a predictable stream of cash for regular expenses—think internet, fuel, power, and other bills.

Caveat: There’s no profit, and sometimes someone may not pay you back. You’d have a hard time fighting for your money from a family member or friend, so be ready to write off the debt if someone fails to meet their payment criteria after a long period (e.g., one year without a payment after their last deposit).

Attempt 2: The Air in bnb or something like that

Everyone raves about real estate this and that, and just like entrepreneurship, the realities of this landscape is not as simple as it seems. If you want long-term returns, invest in the early cycles of either buying up land or financing a housing deal, however if you’re looking for passive short-term / recurring returns, the general advise is to become a “Host” and for the West African market, I choose to either rent a really nice place that I can sub-lease in the heart of cities like Lagos or Accra. Strangely it’s a full-time endeavor. “Hello facility management!” If the apartment isn’t located in a housing estate that includes shared / dedicated FM in their expenses, you’re really up for it.

From cleaning, power, and amenities provisioning to sometimes dealing with the occasional naughty guest, this experience is something I’d rather not discuss. But my friend Harold has been exploring Cribstock and their team has a security partnership with Cardinalstone trustees a SEC licensed trustee and a member of the Cardinalstone partners. This means I can invest somewhere north of 2 million Naira and earn from the rental of a facility in Lagos, sharing the earnings and interests/profits from that facility every month.

Passive income? Yes. Margins? Not much. But here’s what I’ve learned so far:

“YOU NEED A SHIT TON OF MONEY” to actually earn decent passive income in real estate and adjust your profits to around 5% – 15% at best. Any return outside these margins might be a bit greedy and unsustainable (meaning they may be short-term, and a loss might hit you soon, which would then take up your time and possibly money.

The general idea behind passive income is that you can sleep while your wallet still receives those lovely +$$$ without you having to worry about it.

So, in summary: It’s possible, but be prepared for the realities and costs involved

Wild Thoughts

If you’ve read up to this point, it might be best to return later, as the writing that follows is somewhat inconsistent and disconnected.

Attempt 3: RSI, MACD, FX

This is one of the first predictable channels I’ve thought of exploring—not from the numerous airdrops I’ve received as a developer contributing to open-source projects on the blockchain. Thank you, Stark / Celestia, and others.

My first foray into predictable passive income has been trading bots in “spot” accounts, where I let these bots trade tokens on my behalf and accumulate slow profits at the end of the month.

However, last month, I took the risk of exploring trading bots in perpetual and margin accounts. And let me tell you, I’ve learned how to cry. See, I’m not a trader—just a tech bro or something like that. I had no idea how perpetuals work and that you could get liquidated. So, I opened a new trading bot with about 25x leverage and slept on it, only to wake up in the morning to a liquidated account. Spot trades, on the other hand, would leave you with the token even if it’s at a loss, but margin trades liquidate you when you don’t make the right prediction on the market.

I reached out to one of my trader turned real estate bro and he shared some wise words with me, his key takeaway was that

“The market always create opportunities so relax”

Lucky Mark

To put this into context you can easily loose $1,000 daily trading, but I also have seen that you can easily make x2 of the same amount in the same day. So it becomes a game of probability and the goal is to improve your odds on every trade open and close. Good thing is I love predictive analysis… So why don’t I explore this

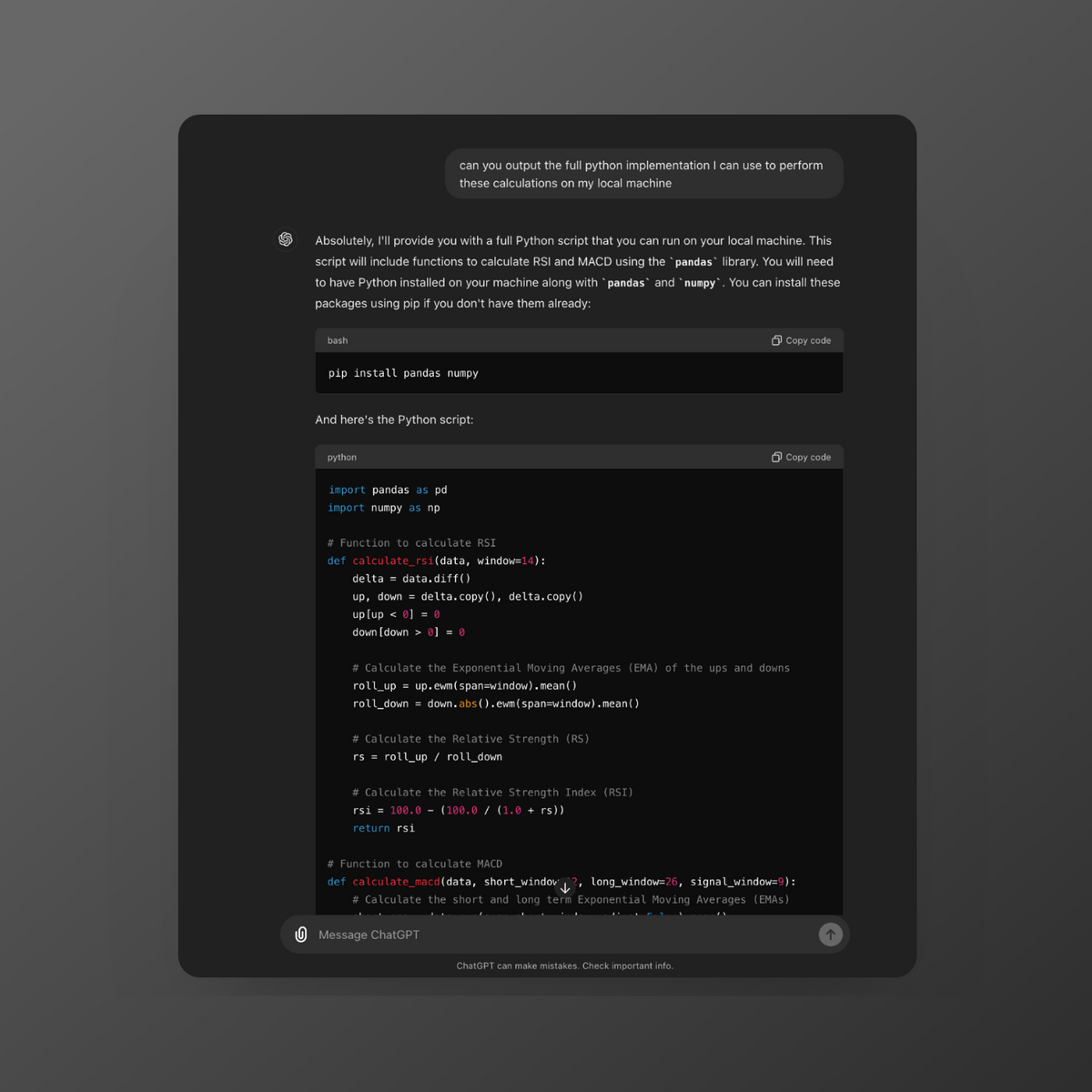

So, I asked ChatGPT… “Can you teach me how to trade and what are the basic things I need to learn to be able to simply ‘LONG,’ ‘SHORT,’ or ‘HOLD’?” And your favorite AI assistant came through.

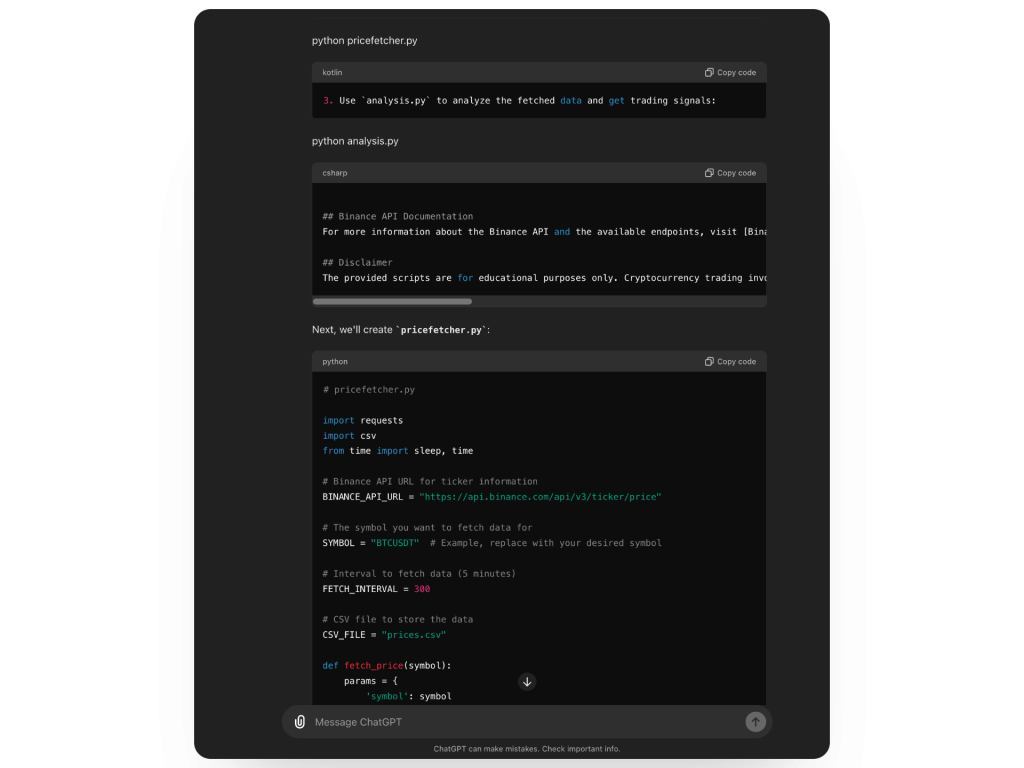

I have a series of conversations with it to write up a python bot that could assist me with trading perpetuals on the 5 – 15 minute candle stick.

Since this is an experiment and I am still scared of loosing soo much money, I am going to update you when I have spare cash to try out trading again.

I’ve had a series of conversations with ChatGPT to write a Python bot that could assist me with trading perpetuals on the 5-15 minute candlestick. Since this is an experiment and I’m still scared of losing too much money, I’ll update you when I have spare cash to try out trading again.

However, do you notice how this is no longer passive? It’s a full-time endeavor and it could either end in profit or loss. And loss is not good. It can mess up your emotions and take away your appetite. So really, where’s the passive nature in this? It seems I have to stick with slow and steady spot account profits, which means more money in my trading accounts. But what if I wanted a bit more and I think I know the direction the market would go?

So while we still work our asses off, at least, by the end of the month, I have a little something I could use to buy new clothes, enjoy any delicacy I cherish, and take my friends out for the sake of vanity without feeling guilty about spending profits that should be re-invested back into the business or kept for that emergency that shows up without warning.

Until then from your financially insecure entrepreneur.

Continue Reading

What does the next era of leverage look like?

From Columbus to AI - how leverage has evolved through geography, infrastructure, code, attention, and now intelligen...

My Claude Codes Better than Yours

In AI native workplaces, the tension is no longer who writes better code. It's who extracts better intelligence. When...

The Side Effect of Vibe Coding Nobody Talks About

A subtle shift from AI coding: reading code faster, and why tiny diffs suddenly feel like a slowdown worth unpacking.